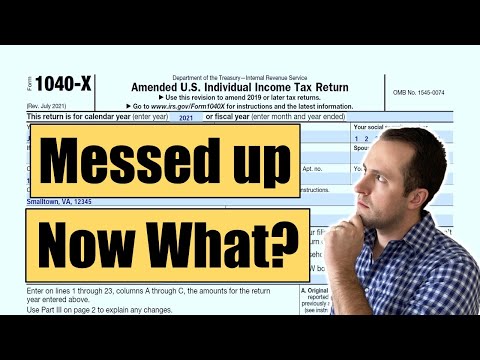

Hey everyone, I'm Bradford with the Penn Peninsula Personal Finance. There are many different reasons why you might need to file an amended tax return. It could be a simple miscalculation or if your work sent you a late W2C. I'm here to ensure that you complete this process correctly. While the IRS does state that they might fix simple math mistakes or missing schedules on your behalf, it's not a chance worth taking. When it comes to taxes, the IRS does not mess around. Even if it's an innocent mistake on your part, you could still face thousands of dollars in fines and fees if you don't correct it. If you have used a tax prep software or a CPA to file an amended return, it should be as simple as providing them with your correct information and letting them handle the rest. However, if you filed your taxes by yourself, that's where I come in to assist you. Now let's talk about the IRS form 1040X. This is the form you will need if you are amending your tax return for the years 2019, 2020, or 2021. If you are trying to file an amendment for a tax year prior to that, you will need to visit the IRS website to get the appropriate version of the 1040X. When you begin filling out the form, it will be very similar to how you filled out your initial Form 1040. As an example, in my video released a couple of months ago, I am amending the tax return that I initially filed. You start by indicating the calendar year you are filing for, which in this case is 2021. Then provide your first, middle initial, and last name, as well as your social security number. If you are filing a joint return, include...

Award-winning PDF software

Video instructions and help with filling out and completing Form Instructions 1040-A vs. Form 1040x