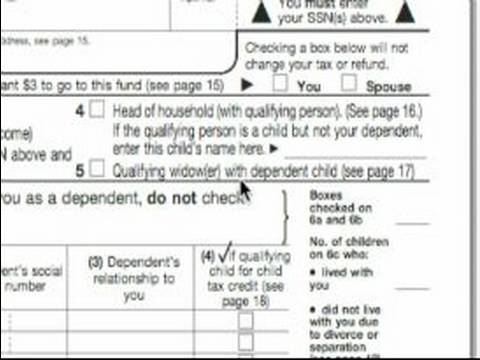

P>Now I'm going to talk about filing status. As a qualifying widow or widower with a dependent child, you can use this filing status. This will entitle you to use joint return tax rates and the highest standard deduction amount if you don't itemize deductions. This gives you a little bit of a break on your taxes. You can file with this status if your spouse died in 2005 or 2006 and you did not remarry before the end of 2007. Additionally, you must have a child or step-child that you claimed as a dependent. However, please note that this status does not include a foster child. In order to qualify, the child must have lived in your home for all of 2007. Furthermore, you should have paid over half the cost of keeping up your home. It's important to note that you could have filed a joint return with your spouse the year he or she died, even if they did not actually do so.

Award-winning PDF software

1040a line 7 Form: What You Should Know

IRS Office of the Chief Counsel for Tax Legislation, IRS-3, 600 Pennsylvania Avenue, NW, Washington, DC 20549. Line by Line Instructions Free File Fillable Forms — IRS Jan 6, 2025 — Line 7 is a field blank page. If not, check here. . . . ▷. 7. 8. Other income from Schedule 1, line 10. Line by Line Instructions Free File Fillable Forms — IRS Mar 21, 2025 — Line 7 asks about your capital gains or losses from the past year. Two common reasons to have capital gains are that you sold stock investments. The first is called a “step-up” and involves a cash transaction. The second is considered a “strict-step-up” in which the amount from line 7 is the greatest of the amounts from line 7a, and your tax-adjusted capital gain on that transaction. For more information, contact your state's tax office for the amount that would be allocated to line 7 for your state's income tax. Line by Line Instructions Free File Fillable Forms — IRS Mar 22, 2025 — Line 7 is a field blank page. If not, check here. . . . ▷. 7. 8. Other income from Schedule 1, line 10. Line by Line Instructions Free File Fillable Forms — IRS May 1, 2025 — Line 7 is a field blank page. If not, check here. . . . ▷. 7. 8. Other income from Schedule 1, line 10. Line by Line Instructions Free File Fillable Forms — IRS Jul 29, 2025 — Line 7 is a field blank page that should not be used for any tax information. Line by Line Instructions Free File Fillable Forms — IRS Sep 6, 2018— Lines 8 and 9 are also blank pages that should not be used for tax information unless you can fill out a return on lines 9a–9e here. Line by Line Instructions Free File Fillable Forms — IRS Sep 21, 2025 — Line 7 is a line-by-line information sheet that is not a complete return. Line by Line Instructions Free File Fillable Forms — IRS Oct 16, 2018— Line 7 asks about your capital gain or losses from the past year. Two basic reasons to have capital gains are that you sold stock investments in the last 12 months. The first is called a “step-up” or strict-step-up and involves a cash transaction.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1040-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1040-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1040-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1040-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040a line 7