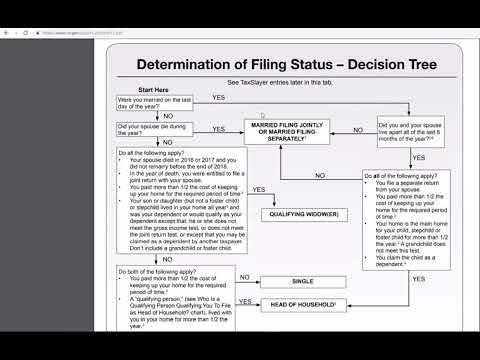

Good morning everyone, this is Med City CPA, and I'm reading through the IRS publications. I came across a common question that I'm usually asked - what is my filing status or what are my options for filing status? Well, in the IRS Publication 012, on roughly page 37 out of 310 pages, they have a decision tree. You can walk through it, and it helps you figure out which filing statuses you can claim. It narrows down the options. For example, if you were remarried on the last day of the year, you need to know the definition. If you answer yes, then you proceed here - did you and your spouse live apart for the last six months of the year? If no, you have these two options. If yes, do all the following apply: you file a separate return, you've paid more than half the cost of your home, your home is the main support of your child or fostered, and you claim the child as dependent head of household. There are also options for claiming multiple households with shared living quarters if certain requirements are met. Additionally, if you have an enlisted child to play with the park, this information may be helpful. Usually, questions arise about what filing status someone can claim. With the new IRS form 1040, this can help people figure out what they actually qualify for. I will put a link in the description below for further assistance. Hopefully, this information is helpful.

Award-winning PDF software

1040 2025 PDF Form: What You Should Know

Form 1098-G (or Form 1120S) and Form 1120-S, Form 1125. 2 The least of the amounts you paid as a home office deduction or state and local income or sales tax on the gross income of the child. You can use Schedule M, Other Additions and Subtractions for Form IL-1040, Line 3 to figure your. 3 Your child's federal tax-exempt interest and dividend income (but not investment income) as reported on Form 1098-G (or Form 1120S) and Form 1120-S, Form 1125. 4 A capital gain or return of capital loss from the disposal of property or the transfer of a deduction. 5 Your child's federal tax-exempt interest and dividend income (but not investment income) as reported on Form 1098-G (or Form 1120S) and Form 1120-S, Form 1125. 6 An increase in the value of a capital asset owned by your child that is used primarily for personal purposes and not used in your trade or business. 7 The cost of your child's participation in a state health benefits program. 8 See Item 2a, “The value of your child's participation in an Indian, Native American, or Alaska Native health benefits program.” 9 The value of your child's qualified tuition and related expenses. 10 The value of your child's qualified tuition and related expenses (including the cost of your child's tuition and fees at an eligible educational institution, provided your child enrolls or is readmitted, within the first two academic years of the child's enrollment or readmission, in the same school for which the school offers financial aid) for tuition in an eligible educational institution for the years the child resides in your home. 11 The value of qualified medical expenses incurred in the year paid by you for a qualified long-term care insurance policy on yourself or your child (provided the coverage is insured by the Federal Employees Health Benefits Program [FDP]). 12 The cost of qualified health services you provided your child in a private health savings account. 13 The value of your child's tuition and fees at an eligible educational institution, provided your child enrolls or is readmitted, within the first two academic years of the child's enrollment or readmission, in the same school for which the school offers financial aid, if the student is enrolled or readmitted on an actual or expected basis.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1040-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1040-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1040-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1040-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 form 2025 PDF